An export declaration is a form that is submitted by an exporter at the port of export. It provides information about the goods being shipped, including type, number, and value. This information is used by customs to control exports, in addition to compiling statistical information about a country’s foreign trade. In the USA an export declaration must be filed when any single commodity being shipped is over 2500 USD. Therefore if you have multiple commodities less than 2500 you do not need to file an export declaration. HOWEVER, if any of the items require an export license or permit you will need to file the export declaration. The Export declaration in the USA is also referred to as an EEI, electronic export information, or AES which refereed to an older system that was used to file the EEI called Automated Export system. In other countries, the threshold or requirements for filing an export declaration may or may not be higher. A shipment from the United States to Canada that exceeds in value does not require an export declaration unless it requires an export license or permit. Shipments from the US to Puerto Rico require an export declaration to be filed, On the other hand, cargo headed from the US to American Samoa, Guam, Northern Mariana Islands, and most of the other U.S. territories are treated as domestic shipments and do not need an export declaration. The U.S. Virgin Islands is a special case: shipments from that territory to either the U.S. mainland or Puerto Rico do not need an export declaration, but cargo headed from the US in the other direction requires an export declaration. An export declaration filing is included in your door to door or door to port rate. However, you will need to submit an SLI or fill out the export declaration information at the time of booking so we can file with customs.

Your door to door and port to door rate includes a basic US customs entry when shipping to USA EXCEPT when its moving on a truck only service from Canada. In this case its an additional fee for the customs entry service. Keep in mind that the customs entry fee is just a fee for submission of the documents to customs and does not include any of the following additional fees that are applicable in for all shipment types regardless of if its a trucking shipment or air and ocean shipment. The following fees will be added to your bill when customs entry services are rendered: Duties and taxes which are based on your commodity, country of export and value of items being imported. In addition there are are other taxes and fees as listed below. ISF surety bond fee which is a fee to ensure the ISF entry provided by the shipper was accurate and correct. There is no ISF surety bond fee IF you have an annual surety bond. Single entry surety bonds are to ensure that the applicable duties and taxes will be paid on the import. Single Entry bonds are 5.00 per thousand dollars of value Min 45. In some cases when additional government agencies are required (FDA, FCC, etc) the bond fee can be based on as much as three times the value of the commodity being imported. You can elect to buy an annual surety bond fee and pay an annual fee which in some cases is lower than paying multiple single entry bonds and ISF bonds every import. Ask our customer service team for a rate on an annual surety bond. MPF ( merchandise processing fee) is a fee imposed by US Customs. The MPF is charged at 0.3456% of the value of the merchandise being imported. There is a minimum fee of $25 and a maximum of $485 for formal entries. MPF is applicable on all imports except De-Minimis value imports. HMF (harbor maintenance fee) is a fee imposed by U.S. Customs and Border Protection (CBP) for U.S. imports shipped via ocean freight. It is charged at 0.125% of the value of the commercial cargo. The HMF is deposited into the Harbor Maintenance trust fund, which may be used by Congress to pay for harbor maintenance, development projects and other related expenses. There is no minimum or maximum for HMF.

Canadian customs entry fee is not to be confused with the Canadian border fee which is a security fee for trucking shipments moving between US and Canada. Canadian customs entries are NOT included in our US to Canada trucking service. It is only included on our international Air and Ocean services. Therefore you must either use your own customs broker to clear Canadian customs OR use the consignees broker. Please be sure to include your Canadian customs brokers information in the special instructions section of your trucking Bill of lading. IF no customs broker information is provided the trucker may elect to move the cargo in bond and therefore incur additional fees. ExFreight can provide you with Canadian customs entry services for additional fees. In addition to the customs entry fee there will be Duties and taxes that would be automatically billed to your account. Even if your commodity qualifies for NAFTA or the new USMCA free trade agreement there will still be sales tax due on the items. In Canada a sales tax is collected at time of import and passed on down through the supplier to end user in each sale. Sales tax rates range from 5%-15% depending on the province the importer resides in. IF you register as a foreign record of importer you can charge the sales tax to your clients and get the money back from them for the tax. If you register as a foreign record of importer you would also need to file a quarterly sales tax return in Canada. Speak with a sales rep about your options. ExFreight cannot collect the duties and taxes collect before delivery on trucking shipments to Canada. Below you will find a chart showing the sales tax for each Canadian Province.

Your door to door and port to door rate includes a basic customs entry at the destination. The customs entry fee is just a fee for submission of the documents to customs authorities and does not include any of the following additional fees that are applicable for all shipment modes: Duties, Sales tax, Import license, and any other local custom levied fee. The following fees will be calculated and billed to the importer. Duties and taxes are typically based on your commodity, country of export and value of items being imported. IF you are the exporter we will bill the destination duties and taxes to the consignee and not you unless you want to arrange the shipment under Delivered Duty Paid terms.

The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) is an internationally standardized system of names and numbers to classify commodities. It came into effect in 1988 and has since been developed and maintained by the World Customs Organization (WCO). Each commodity has its own unique 6 digit number. The HS code is not to be confused with the HTS number or Schedule B number. The HTS number: Harmonized Tariff Schedule (HTS) is administered by the U.S. International Trade Commission (USITC), and the U.S. export classification system, the Schedule B is administered by the U.S. Census Bureau, Foreign Trade Division. Both the HTS and Schedule B numbers use the international HS codes for their first 4- and 6-digit headings and subheadings. Since greater commodity detail are needed than the 4- and 6-digit HS headings and subheadings, the HTS and Schedule B classification systems expand their coverage to statistical descriptions at the 10-digit level. HS numbers and Schedule B numbers will be the same up to the first 6 digits as the importing country’s classification code. A Schedule B number is a 10-digit number used in the United States to classify physical goods for export to another country. The Schedule B is based on the international Harmonized System (HS) of 6-digit commodity classification codes. There is a Schedule B number for every physical product, from paperclips to airplanes. In the US a HTS code is used for the classification of imports while a schedule B number is used for classifications on exports. In most of the rest of the world a H.S. code is used for classification of each commodity

The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) is an internationally standardized system of names and numbers to classify commodities. It came into effect in 1988 and has since been developed and maintained by the World Customs Organization (WCO). Each commodity has its own unique 6 digit number. The HS code is not to be confused with the HTS number or Schedule B number. The HTS number: Harmonized Tariff Schedule (HTS) is administered by the U.S. International Trade Commission (USITC), and the U.S. export classification system, the Schedule B is administered by the U.S. Census Bureau, Foreign Trade Division. Both the HTS and Schedule B numbers use the international HS codes for their first 4- and 6-digit headings and subheadings. Since greater commodity detail are needed than the 4- and 6-digit HS headings and subheadings, the HTS and Schedule B classification systems expand their coverage to statistical descriptions at the 10-digit level. HS numbers and Schedule B numbers will be the same up to the first 6 digits as the importing country’s classification code. A Schedule B number is a 10-digit number used in the United States to classify physical goods for export to another country. The Schedule B is based on the international Harmonized System (HS) of 6-digit commodity classification codes. There is a Schedule B number for every physical product, from paperclips to airplanes. In the US a HTS code is used for the classification of imports while a schedule B number is used for classifications on exports. In most of the rest of the world a H.S. code is used for classification of each commodity

What is an SLI – Shipper’s Letter of Instruction?

An SLI is a Shipper’s Letter of Instruction. This document gives us permission to submit export customs data on your behalf and gives your consent to screen air cargo as well as confirming the general elements of the shipment including pieces, weight, addressees, commodities (including HTS codes if known) etc. Alternatively, you can complete this information online and sign electronically while booking via the ExFreight website.

The exporter of record or primary beneficiary of the shipment (referred to as the USPPI or U.S. Principal Part of Interest) is responsible to provide an SLI for submission to the Automated Export System.

Although all export shipments departing the United States require an SLI, filing electronically through the AES system is only required for products exceeding $2,500 in value.

A Shipper’s Letter of Instruction is required for both air freight and ocean freight export shipments.

A power of attorney gives Exfreight or it’s agents the authority to act on behalf of the customer in customs matters. Below you will find a list of various POA forms. You only need to sign the POA for your imports and specifically for the country you are importing for. For example, a US exporter who is exporting to Europe does not need to sign the European import POA. In that instance, we will contact the consignee at the destination and have them sign the required form.

- USA imports power of attorney (POA) form

- USA imports foreign importer power of attorney (POA) form

- Canada import power of attorney (POA) form

- UK import power of attorney (POA) form

- Europe import by sea via Rotterdam power of attorney (POA) form

- Netherlands import by sea power of attorney (POA) form

- Netherlands import by air power of attorney (POA) form

- Netherlands import by air foreign power of attorney (POA) form

- Germany import by air power of attorney (POA) form

- France import by air power of attorney (POA) form

Customs Duty is a tariff or tax imposed on goods when transported across international borders. The purpose of Customs duty is to protect each country’s economy, residents, jobs, environment, etc., by controlling the flow of goods, especially restrictive and prohibited goods, into and out of the country.

Taxes can sometimes be confused as duty however, they are specifically taxes on the imported items. Some countries charge the sales tax from time of import along the chain of sale, from the importer to the end buyer or consumer. For example, Importer A imports 1000 dollars worth of widgets. They pay the 20% sales tax at the time of import to Customs. Importer A then sells the goods for 2000 USD and charge the end buyers the same 20% tax. Importer A will then also file a sales tax return with the government and remit the extra tax collected for the difference between what they paid at the time of import and collected at the time of sale. In other countries, the sales tax is just collected at the end point of sale.

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to and is often compared with, a sales tax. Importers who import into countries that have applicable VAT taxes in place will be required to pay VAT tax on the items they import at the time of import. VAT tax on the imported item is not included in your Exfreight shipping quote. VAT tax can also be applicable on the freight charges in some countries on certain types of freight movements. IF VAT tax is applicable on the freight charges for your move we will include that on the freight quote but this should not be confused with the VAT tax applicable on the value of any imported commodity when it’s applicable.

The HST is a consumption tax in Canada that is paid by the consumer and businesses at the point of sale (POS). The vendor collects the tax proceeds by adding the HST rate to the cost of goods and services and then remits the collected tax to the Canada Revenue Agency (CRA), the tax division of the federal government. The CRA later allocates the provincial portion of the HST to the respective provincial government. HST is also collected at the time of importation by Canadian customs from the importer. Its in addition to any applicable DUTY. The importer can usually recoup this tax when they sell the item by passing on the tax to the end buyer.

Importers who import into Canada will be required to pay HST tax on the items they import at the time of import. HST tax on the imported item is not included in your Exfreight shipping quote. HST tax can also be applicable on the freight charges on certain types of freight movements. IF HST tax is applicable on the freight charges for your move we will include that on the freight quote but this should not be confused with the HST tax applicable on the value of any imported commodity when it’s applicable.

GST is also known as goods and services tax is levied on supplies of goods or services purchased in Canada and includes most products, except certain politically sensitive essentials such as groceries, residential rent, and medical services, and services such as financial services. Businesses that purchase goods and services that are consumed, used, or supplied in the course of their “commercial activities” can claim “input tax credits” subject to prescribed documentation requirements (i.e., when they remit to the Canada Revenue Agency the GST they have collected in any given period of time, they are allowed to deduct the amount of GST they paid during that period). This avoids “cascading” (i.e., the application of the GST on the same good or service several times as it passes from business to business on its way to the final consumer). In this way, the tax is essentially borne by the final consumer..

Import/Export (I/E) Licenses are issued only by the U.S. Fish and Wildlife Service (FWS) Office of Law Enforcement (OLE) and are issued to entities (companies or individuals) before they commercially import into or export from the United States shipments containing wildlife (including their parts and products). You are required to obtain your I/E License prior to commercially importing into or exporting from the United States shipments containing wildlife, their parts, or products.

The Endangered Species Act (ESA) (16 U.S.C. §§ 1531-1544) defines the term “fish or wildlife” as “any member of the animal kingdom, including without limitation any mammal, fish, bird (including any migratory, nonmigratory, or endangered bird for which protection is also afforded by treaty or other international agreement), amphibian, reptile, mollusk, crustacean, arthropod or other invertebrates, and includes any part, product, egg, or offspring thereof, or the dead body or parts thereof.”

A License is not required for personal use. Personal use means use that is for an individual’s own consumption or enjoyment and not for commercial use. Examples below are not a complete list: • Hobbyists, unless wildlife is for sale, trade, or barter • Personal Pets • Tourist souvenirs • Personally sport-hunted trophies imported or exported by the hunter • Fish taken for recreational purposes, However, even though an I/E License is not required for your activity, you should check the regulations to determine if your shipment requires any other type of permission from FWS (designated port exception permit, inter-state transport, possession, etc.)

Under the Lacey Act, it is unlawful to import, export, sell, acquire, or purchase fish, wildlife or plants that are taken, possessed, transported, or sold: 1) in violation of U.S. or Indian law, or 2) in interstate or foreign commerce involving any fish, wildlife, or plants taken possessed or sold in violation of State or foreign law.

The law covers all fish and wildlife and their parts or products, plants protected by the Convention on International Trade in Endangered Species of Wild Fauna and Flora, and those protected by State law. Commercial guiding and outfitting are considered to be a sale under the provisions of the Act.

In 2008, the Lacey Act was amended to include a wider variety of prohibited plants and plant products, including products made from illegally logged woods, for import. When the Lacey Act was passed in 1900, it became the first federal law protecting wildlife. It enforces civil and criminal penalties for the illegal trade of animals and plants. Today it regulates the import of any species protected by international or domestic law and prevents the spread of invasive, or non-native, species.

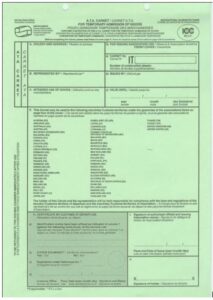

If you are temporarily exporting or importing your shipment for any reason, whether it be for a trade show or for any other reason its important to consider who will pay the destination duties and taxes before you ship. In some countries, a temporary import can be made and the duties and taxes can be refunded once exported. This can still be a drain on budgets as duties and taxes can be in excess of 20-40% of the value of the commodity you are shipping. Additionally, the refund process with the foreign customs agency can take months. Alternatively, you can also consider setting up a Carnet for your shipment. A Carnet is an international customs and temporary export-import document. It is used to clear customs in 87 countries and territories without paying duties and import taxes on merchandise that will be re-exported within 12 months. You can set up a Carnet and Exfreight can process the export and import clearances with it and defer any duties and taxes. Exfreight does not set up Carnets but we can process your shipment once you have set up a Carnet. There are additional fees to process export and import clearances with Carnets. Please check with operations for the additional fees which range from an additional 100 – 350 dollars per customs entry.

The de minimis rule or de minimis value is the value set by each Countries customs offices under which no customs duties or taxes are applied at the time of import.

The importer of record is the person or entity officially responsible for ensuring the import transaction complies with all the regulations in that country, that goods are correctly valued, pays the relevant taxes and duties, and files all the correct documentation and permit. They are recorded on the customs entry as the responsible party and therefore assume the risk for any deviation or misclassification on the entry with customs.

The Importer Security Filing (ISF) also referred to as 10+2, requires ocean cargo information, for security purposes, to be transmitted to the US customs at least 24 hours prior to the cargo being loaded onto an ocean vessel headed to the U.S., and requires importers to provide 10 data elements to US Customs as well as 2 more data documents (Container Status Messages and the vessel’s Stow Plan)from the carrier. If you book your cargo to DOOR this filing is included in the Exfreight service.

The customs surety bond is a contractual agreement between the Importer of record, the Bond Surety Company, and US Customs. Customs Bonds facilitate faster Customs clearance because they guarantee the US Customs will be immediately paid if any additional import duties, taxes or fees need to be assessed. This allows the US Customs to clear the shipment without having to wait for the Importer to submit payment. If there is a failure by the importer of record to pay any duties or taxes, US Customs will file a claim on the bond with the surety company and collect from the bond. The Surety company will then attempt to collect from the import of record.

Customs Bonds are available as Single-Entry bonds, which cover individual shipments, or as Annual/Continuous Customs Bonds, which cover all shipments over a 12-month period. Customs Bonds are required by US customs for all commercial imports valued at $2500 or more, even if a shipment is duty-free.

If you do not have an annual bond in place the Customs Surety bond is NOT included in your rate quote and will be billed additionally along with the applicable duties and taxes at the time of arrival to the destination port.

The Merchandise Processing Fee (MPF) is a US Customs ad valorem fee of 0.3464 percent. The fee is based on the value of the merchandise being imported, not including duty, freight, and insurance charges. The maximum amount of the fee shall not exceed $528.33 and shall not be less than $27.23 For example if 0.3464 percent of the amount of your merchandise is greater than the maximum amount of $528.33, the importer is only required to pay the maximum amount of $528.33.

MPF for informal entries is assessed on goods that are transported to the U.S. via air, ship and international mail. MPF for informal entries is a set fee and ranges from $2.00, $6.00 or $9.00 per shipment. Formal and informal entries are subject to a manufacturing processing fee. The Code of Federal Regulations requires the importer of record to pay the fee to Customs and Border Protection (CBP) at the time of presenting the entry summary. Formal entries are required for imports of commercial goods valued at $2,500 or more.

Informal entries generally, do not require a CBP bond and are usually for personal use imports or commercial imports valued less than $2,500 (only if the Port Director requests based on importation).

The MPF fee is NOT included in your online quote and will be billed at the time of arrival into the US along with any applicable duties and taxes.

The Harbor Maintenance Fee (HMF) is a fee imposed by US Customs for U.S. imports shipped via ocean freight. It is charged at 0.125% of the commercial cargo value shipped through identified ports. The HMF is deposited into the Harbor Maintenance trust fund, which may be used by Congress to pay for harbor maintenance, development projects, and other related expenses.

The HMF fee is NOT included in your online quote and will be billed at the time of arrival into the US along with any applicable duties and taxes.

An FDA hold is a customs hold on your US import. US Customs will place holds on certain commodities that may require further review to ensure they meet FDA standards and regulations. Products regulated by the FDA may be stopped for an FDA hold upon import into the U.S. The FDA regulates products that fall under the following categories:

- Tobacco products

- Human foods

- Human drugs

- Medical devices

- Cosmetics

After review, US Customs may either proceed to inspect the cargo, request additional information, release the cargo, or escalate the shipment to an intensive exam.

General order is a status given to imported cargo that has not had a customs entry submitted to US customs after a set amount of time. Once a shipment is placed in general order its moved to a special warehouse for another set amount of time. Storage fees will incur at the general order warehouse while the cargo is there. If the cargo is not customs cleared while at the general order warehouse it will eventually be sold at the general order auction to the highest bidder. The funds collected at the auction will be used to pay the general order storage fees and any other freight or previous warehouse or port storage fees that were due.